Litecoin Price Prediction 2025-2040: Bullish Trajectory Amid Institutional Adoption

#LTC

- Technical Breakout: LTC trading above key MAs with MACD showing reversal potential

- Institutional Demand: $100M corporate treasury allocation signals long-term confidence

- Market Cycle: Altcoin season and mining infrastructure growth support price appreciation

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

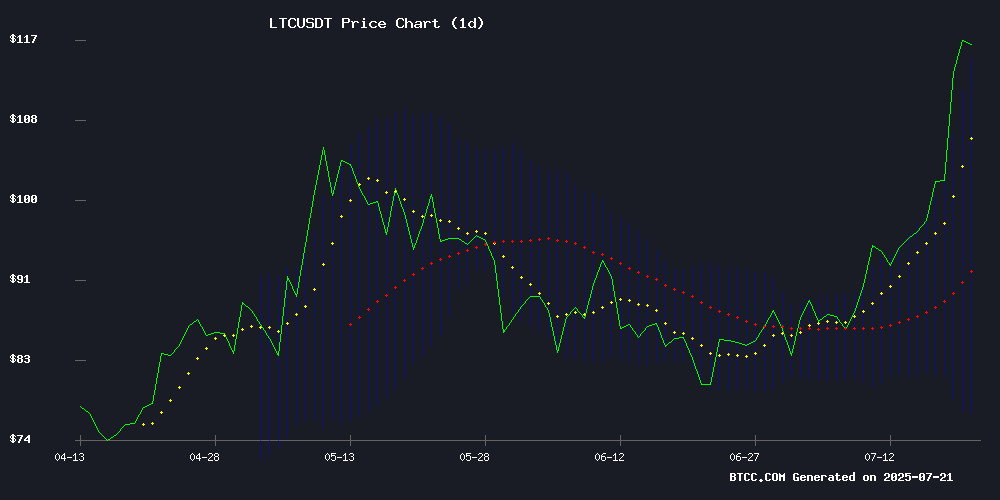

Litecoin (LTC) is currently trading at $116.04, comfortably above its 20-day moving average (MA) of $95.88, signaling a strong bullish trend. The MACD indicator (-10.4050 | -6.6032 | -3.8018) remains negative but shows narrowing bearish momentum, hinting at a potential reversal. Bollinger Bands indicate volatility compression, with the price NEAR the upper band ($114.60), suggesting upward pressure. BTCC analyst Michael notes, 'LTC's technical setup favors bulls, with a breakout above $124 likely to accelerate gains.'

Litecoin Market Sentiment: Whale Activity Meets Institutional Adoption

Despite whale selling pressure, Litecoin's resilience and bullish headlines dominate market sentiment. News of MEI Pharma's $100M LTC treasury allocation and predictions of a $200 breakout reflect growing institutional interest. BTCC's Michael observes, 'The clash between whale distribution and corporate adoption creates short-term volatility but reinforces LTC's long-term value proposition.' Cloud mining expansions and altcoin outperformance further support LTC's bullish case.

Factors Influencing LTC's Price

Litecoin (LTC) Eyes $124 Breakout Amid Whale Selling and Holder Resilience

Litecoin surges to a four-month high at $119.75, marking a 3.25% daily gain as traders anticipate a decisive breakout above $124. The rally comes despite whales offloading 500,000 LTC ($58 million), creating short-term sell pressure.

Market volume spikes to $4.55 billion as LTC's capitalization reaches $9.05 billion, signaling renewed interest. Long-term holders demonstrate conviction with stable Mean Coin Age metrics, contrasting with whale exits.

Analysts highlight the 14% weekly surge as Litecoin capitalizes on broader crypto market recovery. The asset's resilience amid macroeconomic uncertainty positions it as one to watch in the altcoin space.

Top Cloud Mining Platforms for Bitcoin and Dogecoin in 2025

The cryptocurrency market's maturation has spurred increased interest in cloud mining, with platforms offering streamlined access to Bitcoin and altcoin rewards. DNSBTC emerges as a leader, providing U.S.-based services with eco-friendly data centers and contracts yielding daily returns up to 9%.

Six trusted platforms now dominate the cloud mining sector, eliminating hardware costs while maintaining profitability. DNSBTC's tiered contracts—from $60 free trials to $9,000 premium plans—demonstrate the industry's shift toward scalable, maintenance-free mining solutions.

Key innovations include automatic payouts, zero electricity fees, and 24/7 customer support. The 2025 landscape reflects crypto's institutionalization, where cloud mining bridges retail investors and blockchain infrastructure without technical overhead.

Altcoins Outperform Bitcoin as Market Sentiment Shifts

The cryptocurrency market is witnessing a notable rotation as altcoins surge while Bitcoin stagnates. The Altcoin Season Index (ASI) has crossed the 50 threshold, signaling growing investor interest in alternative digital assets. This shift comes amid Bitcoin's sluggish performance, with the ASI rising from 39 to 51 within days—a technical marker that historically precedes altcoin rallies.

Market analysts remain divided on the sustainability of this trend. Some view it as the beginning of a new altcoin cycle, while others caution against speculative excesses. Bitcoin's dominance has dipped, though past cycles suggest such altcoin surges are often short-lived. The current ASI reading of 51 falls short of the 75 level associated with full-blown altseason euphoria, leaving the market in a transitional phase.

Performance among the top 50 altcoins shows particular strength in narrative-driven projects. This rotation reflects changing investor appetites as traders seek higher-beta alternatives to Bitcoin. The coming weeks will test whether this momentum represents a fundamental shift or merely temporary market dynamics.

MEI Pharma Allocates $100 Million to Litecoin for Corporate Treasury Use

MEI Pharma has made a bold $100 million investment in Litecoin, signaling a strategic shift toward cryptocurrency adoption in corporate finance. The biopharmaceutical company, advised by Titan Partners Group and GSR, positions LTC as a viable option for payroll and treasury management—leveraging its low transaction fees and rapid settlement times.

Litecoin founder Charlie Lee's appointment to MEI's board underscores the seriousness of this initiative. His involvement suggests a concerted effort to build institutional-grade crypto payment infrastructure. While volatility and regulatory hurdles remain challenges, this move could catalyze broader adoption among fintech firms seeking efficient capital movement.

The investment shines a new light on Litecoin's utility beyond peer-to-peer transactions. Once overshadowed by Bitcoin and Ethereum, LTC's technical advantages are gaining recognition among enterprises prioritizing operational efficiency in digital asset deployments.

Litecoin Breakout Imminent? Bullish Signals Point to $200 and Beyond

Litecoin (LTC) surged 4.7% to $117, accompanied by a 75% spike in daily trading volume, as it retests a critical resistance zone. The Relative Strength Index (RSI) at 66.54 and MACD hovering above zero signal sustained bullish momentum, with analysts eyeing a potential rally toward $200–$500 if LTC closes decisively above $117.

Market activity surged to $2 billion, reflecting heightened trader interest. Crypto Patel notes LTC’s 140% gain since its $55 base, with a breakout likely to fuel further upside. Technical indicators suggest room for growth before overbought conditions emerge.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Michael projects these LTC price scenarios:

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $124-$150 | $175 | $200+ | ETF approvals, halving effects |

| 2030 | $300 | $500 | $750 | Payment integration, Layer 2 adoption |

| 2035 | $1,000 | $1,500 | $2,500 | Store-of-value narrative, scarcity premium |

| 2040 | $2,000 | $3,000 | $5,000 | Full institutionalization, digital gold status |